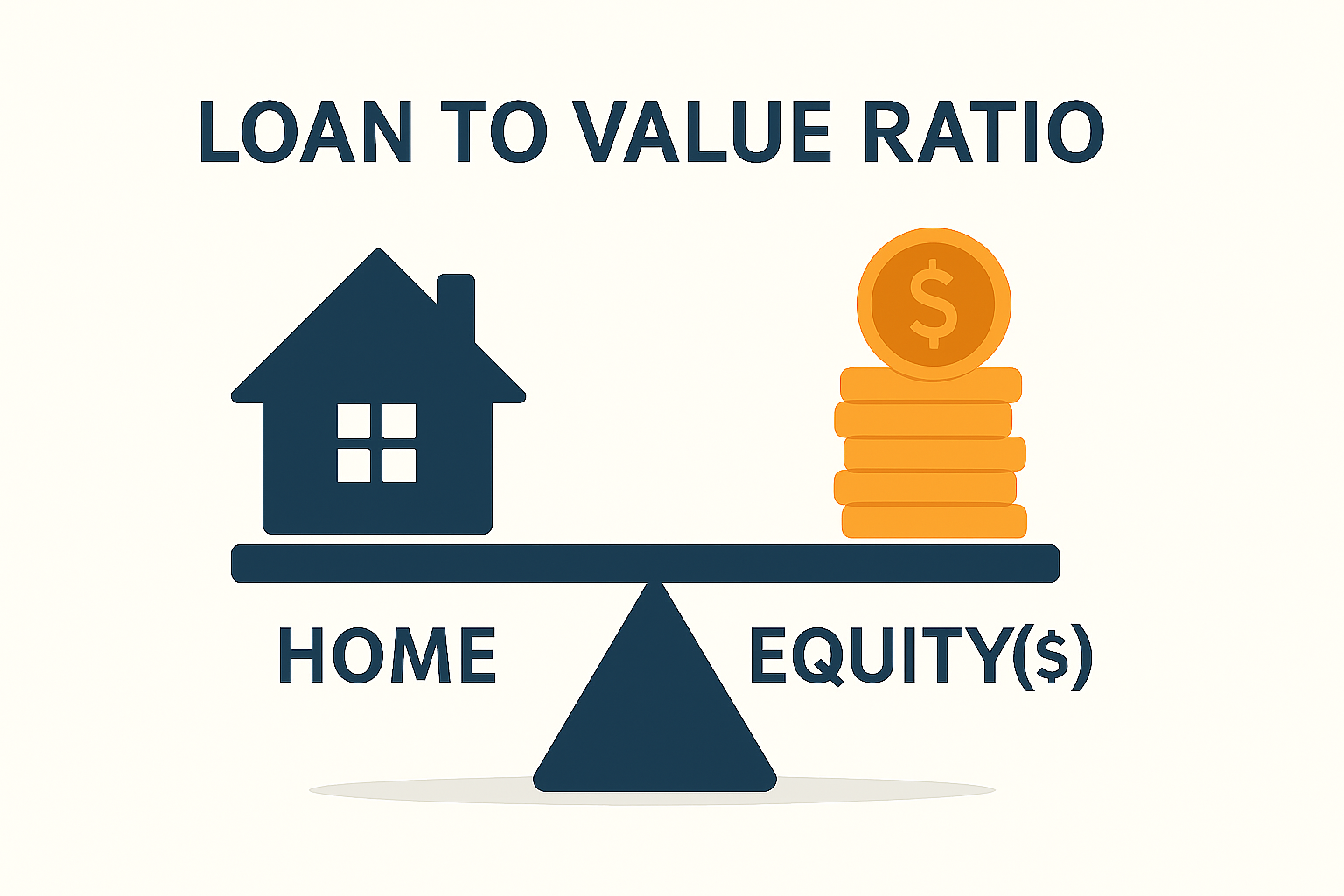

The loan to value (LTV) ratio is a key factor lenders use to assess risk and determine how much they’re willing to lend you. In Canada, a lower LTV can help you access better mortgage rates, avoid costly insurance, and unlock more equity from your home. This guide covers how LTV is calculated, how it affects mortgage approvals, and why it varies by property location and lender.

Table of Contents

ToggleWhat is Loan to Value (LTV)?

Loan to value (LTV) refers to the percentage of your home’s value that you’re borrowing against through a mortgage or home equity loan.

How to calculate it:

Example:

A $400,000 mortgage on a $500,000 home = 80% LTV.

Why it matters:

- It determines your borrowing limit.

- Influences your interest rate.

- Helps lenders evaluate risk.

How LTV Impacts Mortgage Approval

Lenders use your loan to value ratio to assess how risky it is to lend to you.

In general:

- LTV below 80% is ideal and doesn’t require mortgage insurance.

- LTV over 80% typically requires CMHC insurance and additional scrutiny.

Key takeaway:

The lower your LTV, the more likely you are to get better interest rates and more flexible loan terms.

Loan to Value and Home Equity Access

LTV isn’t just important when you’re buying a home—it’s also crucial when accessing equity.

Common ways to use equity:

- Refinancing to consolidate debt

- Taking out a home equity loan

- Getting a HELOC

Let’s say your home is worth $600,000 and you owe $300,000—your LTV is 50%, and your available equity is strong.

Common myth: LTV only matters at the time of purchase.

Reality: It’s just as important when refinancing or applying for a second mortgage.

Understanding LTV for HELOCs and Second Mortgages

For HELOCs and second mortgages, LTV plays a major role:

- Most A lenders cap LTV at 80%

- Private lenders may go up to 85–90%, but with higher costs

A second mortgage adds to your total borrowing, so lenders will look at the combined LTV of all debts secured against your property.

Important to note: Not all lenders allow you to borrow to the full 80%. Each lender has its own comfort zone based on credit, income, and property location.

Factors That Affect Loan to Value Ratios

Several elements can shift your loan to value ratio and how lenders perceive it:

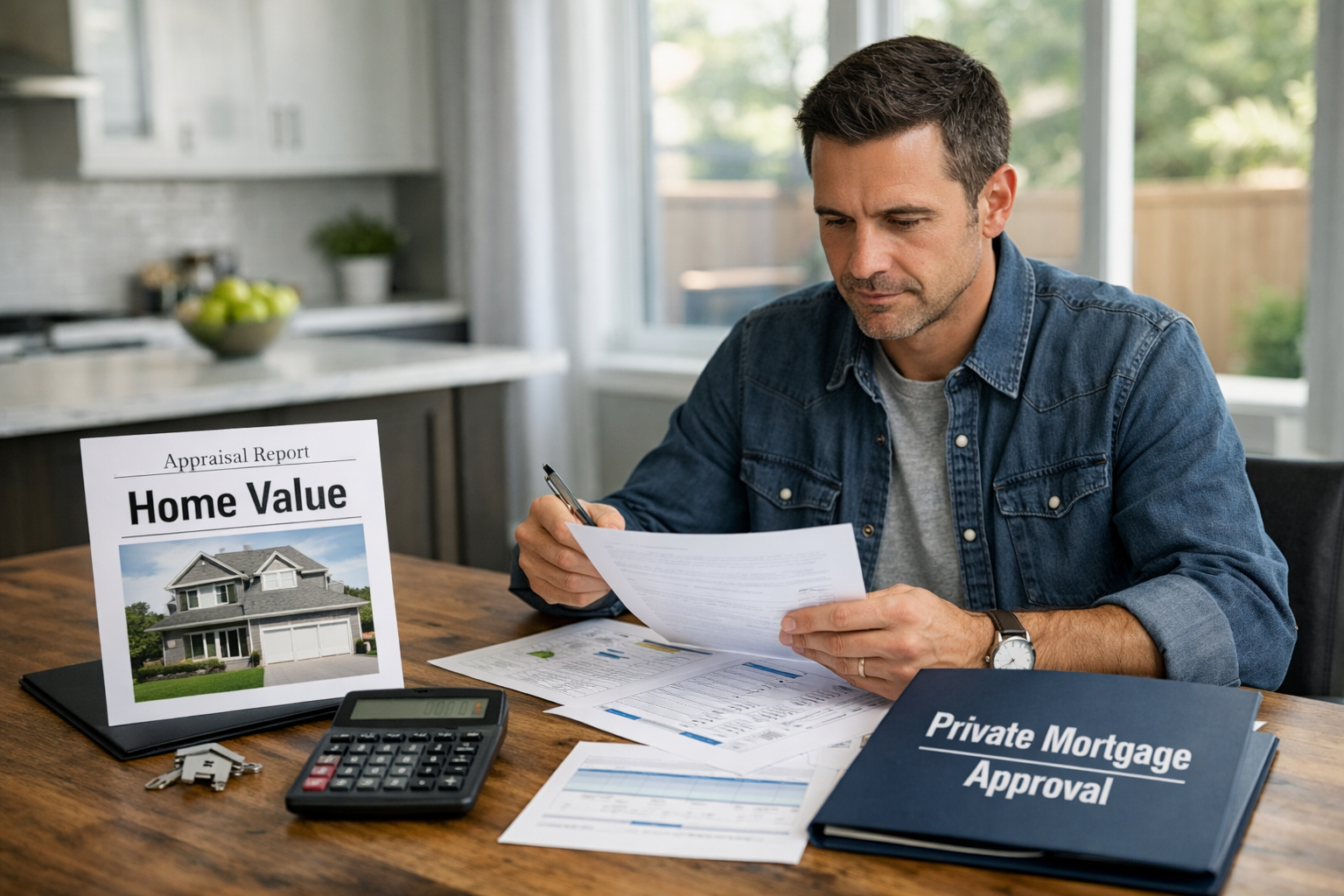

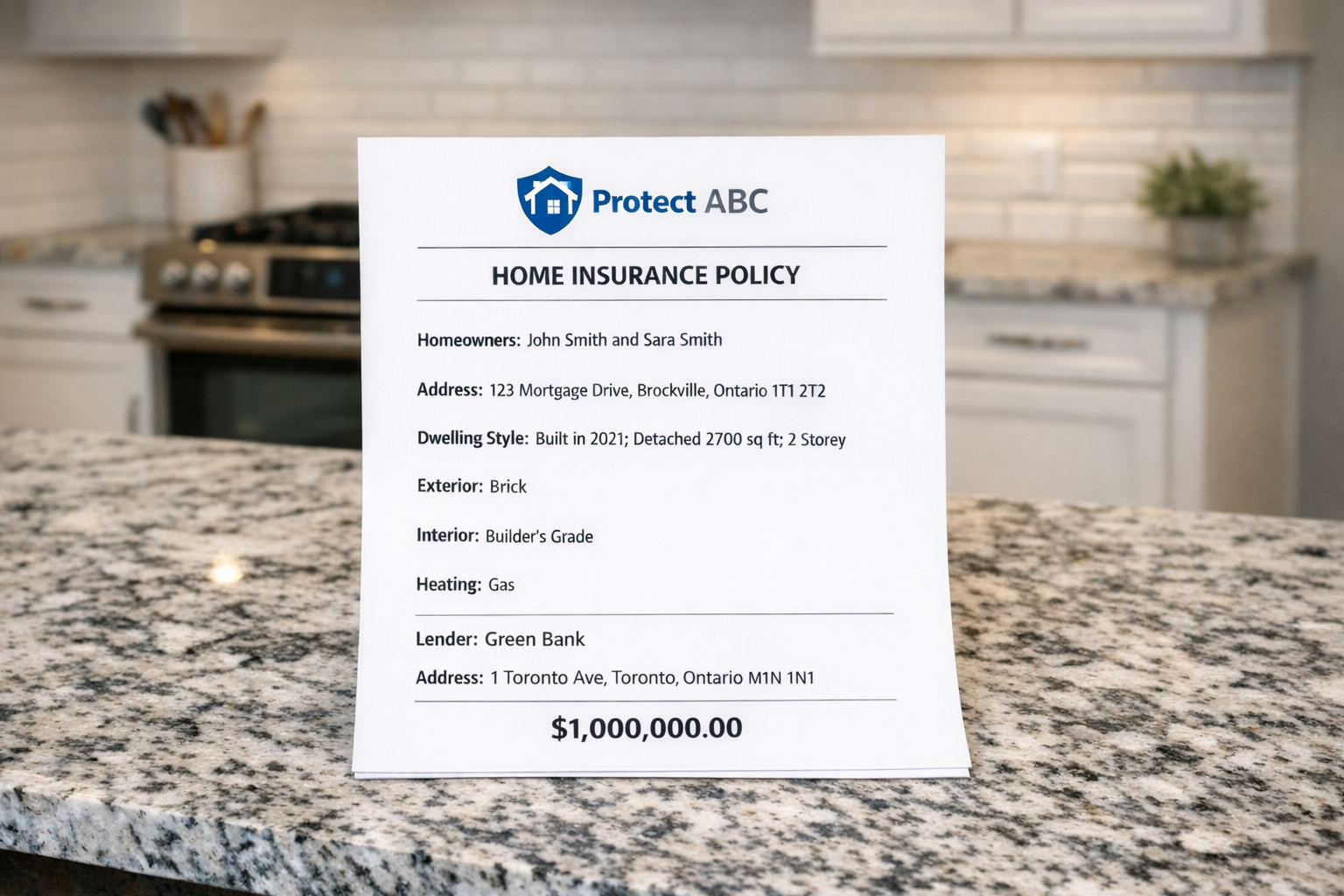

- Appraised Value: Lenders use a professional appraisal to determine fair market value—not the listing price.

- Loan Amount: The more you borrow, the higher your LTV.

- Market Conditions: A downturn could lower your property’s value, increasing your LTV.

- Credit Score: With some institutional lenders, your credit score can influence how much loan-to-value they’re willing to offer. Lower scores may lead to more conservative lending, even if the equity is strong.

Common mistake: Believing your real estate agent’s opinion of value is enough. Lenders require accredited appraisers to assess risk accurately.

Loan to Value Based on Location

Not all properties are evaluated equally. Your loan-to-value ratio may be restricted depending on where your property is located.

Urban vs. Rural:

- Urban/Suburban Properties (Toronto, Mississauga, Ottawa, Calgary):

Often receive higher LTV approvals, up to 80–85%, due to strong market demand and easier resale potential. - Rural Properties (e.g., farmland, off-grid homes, recreational land):

Many lenders scale back the LTV—approvals may be capped at 65–75% or lower, depending on the specific location and property type.

Why does this happen?

- Resale risk is higher in rural areas, making lenders more cautious.

- Fewer comparables for appraisals make it difficult to assess value accurately.

- Limited access to services or infrastructure (e.g., road maintenance, utilities) affects the property’s marketability.

- Well & Septic Systems are often present in rural properties, which can be a concern for both institutional and private lenders. These systems may raise red flags due to potential maintenance issues, environmental concerns, or future costs, leading lenders to reduce the acceptable LTV as a precaution.

Key takeaway: A rural location may limit your borrowing—even with excellent credit and equity—especially if the property is on a well and septic system.

Strategies to Improve Your Loan to Value

If your LTV is too high, here’s how to lower it and increase your chances of approval:

✅ Increase property value

- Renovate kitchens, bathrooms, or improve curb appeal

✅ Pay down your mortgage

- Apply lump sum payments or accelerate payments

✅ Avoid additional borrowing

- Minimize new credit applications during the mortgage process

✅ Use a co-signer

- In rare cases, this may increase lender comfort to allow higher LTV

LTV Limits by Lender Type

Not all lenders offer the same flexibility when it comes to loan to value.

| Lender Type | Typical Max Convetional LTV | Notes |

|---|---|---|

| A Lenders (Banks) | 80% | Allow 95% with CMHC or Genworth insurance |

| Credit Unions | 80% | More flexible with strong clients and allow 95% with CMHC or Genworth insurance |

| Private Lenders | Up to 80% | Higher cost, equity-based approvals. 85% in rare cases. |

Important to note: Private lenders care less about credit and more about equity—but may restrict LTV based on location or property type.

✅ Checklist: Improve Your LTV Before Applying

- ⬆️ Get a current home appraisal

- 💳 Pay down existing debts

- 🧱 Renovate to increase home value

- 📈 Recheck the property value if the market improves

- 🏦 Compare lender types for better LTV allowances

Frequently Asked Questions (FAQ)

Q: What’s the maximum loan to value allowed in Canada?

A: All A & B lenders cap LTV at 80% in 2025, though you can borrow up to 95% with CMHC-insured mortgages. For HELOCs and refinances, 80% is the standard max.

Q: Can I get a loan with a 90% LTV?

A: Only insured mortgages from A lenders allow this, and it’s mainly for purchase mortgage transactions. If you already own your home and are looking for equity, you’ll typically need to stay under 80% unless working with a private lender.

Q: What is the difference between LTV and home equity?

A: LTV shows how much of your home’s value you’re borrowing. Home equity is the opposite—how much of the home you own and can use for borrowing.

Q: Do private lenders use LTV the same way?

A: Mostly, yes. But private lenders may lend with higher LTVs based on the property, location, and risk tolerance. Costs are typically higher.

Q: Can I still get approved if my LTV is high?

A: It depends on your credit, income, and the lender. Private lenders may approve higher LTVs, but your interest rate and fees will likely be higher, too.

Final Thoughts: Why Loan to Value Matters More Than You Think

Your loan to value ratio isn’t just a number—it’s the gateway to your borrowing power in Canada. Whether you’re buying a home, refinancing, or unlocking equity, understanding your LTV can make or break your financing strategy.

Key Takeaway:

The more equity you have, the better your options. Keep your LTV low to secure better terms, avoid insurance premiums, and gain financial flexibility.

- Can a Mortgage Company Evict You in Ontario? (2026 Power of Sale Guide) - February 23, 2026

- Crucial Ways to Survive the Redemption Period During Foreclosure: A Guide - February 21, 2026

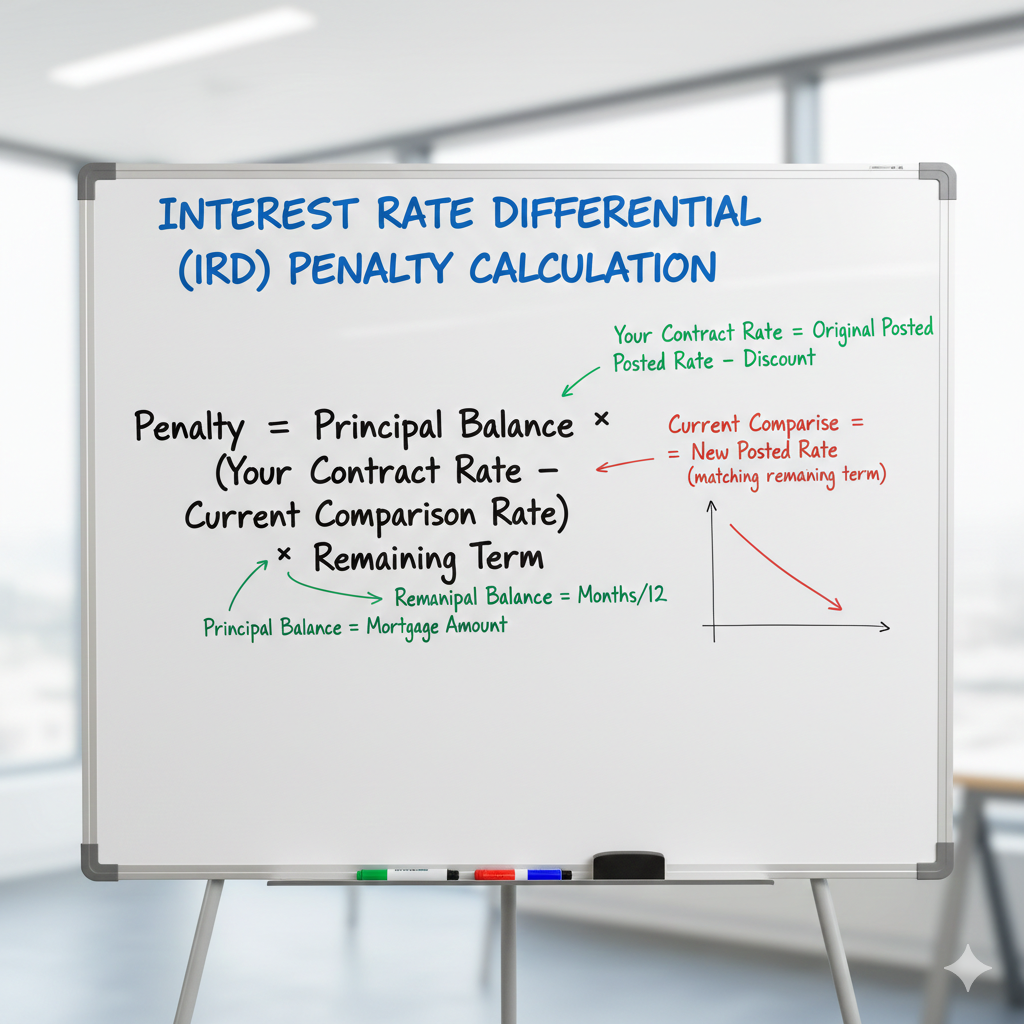

- Painful Realities of the Interest Rate Differential Penalty You Must Know - February 15, 2026