If your credit is less than perfect, you’re not alone—and it’s not the end of your homeownership journey. In fact, a bad credit mortgage in Canada opens doors that traditional banks may close. Whether you want to refinance your current mortgage or buy a new home, there are still solutions available.

This guide breaks down everything you need to know about refinancing or buying a home in 2025 with bruised or poor credit, including lender options, benefits, tips to improve your score, and common questions Canadian homeowners ask.

Table of Contents

ToggleCredit Score 101 in Canada

Your credit score is the number lenders use to measure how well you’ve managed debt in the past. In Canada, scores are issued by Equifax and TransUnion.

Here’s a simple breakdown of how scores are viewed in 2025:

| Credit Score Range | Rating | Impact on Mortgage Approval |

|---|---|---|

| 760 – 900 | Excellent | Best rates and widest lender options (A lenders). |

| 680 – 759 | Good | Qualifies for most bank mortgages. |

| 640 – 679 | Fair | Still considered but limited with banks. |

| 580 – 639 | Poor | Banks decline, but some B lenders may consider. |

| 300 – 579 | Very Poor | Banks decline, private lenders most likely option. |

A score under 640 often makes it difficult to qualify with traditional banks. But private mortgage lenders and alternative (B) lenders step in to provide solutions.

2025 Lender Options: Banks vs. Private Lenders

Not all lenders look at your application the same way. Here’s how options compare:

| Lender Type | Typical Requirements | Pros | Cons |

|---|---|---|---|

| Banks (A Lenders) | 680+ credit score, stable income, low debt ratios | Best rates, lowest fees | Decline most applicants with bruised or bad credit |

| Credit Unions | Flexible depending on membership and income | Sometimes more lenient than banks | Still strict on credit in many cases |

| B Lenders (Alternative) | 600+ credit, stable income, equity in home | Easier qualification than banks | Higher rates & fees than banks |

| Private Lenders | Focus on equity, not credit; proof of property value | Approve low credit scores, fast funding, flexible | Higher rates and fees, usually short-term loans |

Key takeaway:

-

If your score is 680+, banks are still an option in 2025.

-

If your score is under 600, private lenders are often the only path to mortgage approval.

Benefits of a Bad Credit Mortgage or Refinance

Even if your credit is damaged, there are advantages to securing a mortgage or refinance:

-

Improve Your Credit Score

Paying a mortgage on time builds a strong repayment history, one of the biggest credit score boosters. -

Keep Your Dream of Homeownership Alive

Renting is often more expensive in the long run. Even with bruised credit, a bad credit mortgage may make owning more affordable than renting. -

Refinance and Stay in Your Home

If you already own a property, refinancing with bad credit lets you tap into equity, lower payments, or restructure your loan without selling. -

Build Equity Over Time

Every payment increases your ownership stake in the home. With Canada’s housing markets still appreciating in 2025, equity growth is a major advantage. -

Lower Payments Through Refinancing

Consolidating debts into your mortgage often lowers monthly payments and improves cash flow.

How to Boost Your Score Before or After Getting a Bad Credit Mortgage in Canada

Even with poor credit today, you can make improvements that open more doors in the future.

-

Pay Bills on Time

Automate payments to avoid missed deadlines. -

Create a Budget

Track your income and expenses to identify savings opportunities and avoid new debt. -

Give It Time

A longer history of on-time mortgage and bill payments steadily increases your score. -

Pay Down High-Interest Debts

Reducing credit card balances improves your debt-to-income ratio—a key factor lenders use.

Refinancing vs. Buying a New Home With Bad Credit

Here’s how the two options compare in 2025:

| Option | What It Means | Who It Helps |

|---|---|---|

| Bad Credit Refinance | Replace your current mortgage with a new one (possibly with a private lender). Access equity, lower payments, or consolidate debts. | Existing homeowners who want to keep their home. |

| Bad Credit Purchase Mortgage | New mortgage for buying a home, often through a private lender if credit is under 600. | Renters or those moving homes with bruised credit. |

Down Payment – Bad Credit Mortgage in Canada

| Lender Type | Minimum Down Payment | Credit Requirements | Notes |

|---|---|---|---|

| A Lenders / Banks | 5% | Good credit required (typically 680+) | Best rates, CMHC-insured options available. |

| Trust Companies | 5% – 20% | Flexible—will work with bruised credit borrowers | Down payment depends on score and file strength. |

| B Lenders | 20% or more | Can consider lower scores (500–640) | Requirements vary by property type and income stability. |

| Private Lenders | 20% or more | Focus more on equity than credit | Often short-term solutions, higher rates and fees. |

Closing Costs Among Bruised Credit Lenders

| Lender Type | Approval Speed | Typical Fees | Key Takeaway |

|---|---|---|---|

| A Lenders / Banks | Slow (2–4 weeks, sometimes longer) | Low to none (legal + appraisal only) | Best long-term rates, but a strict approval process. |

| Trust Companies | Moderate (1–3 weeks) | Moderate (lender + broker + legal + appraisal) | Flexible on credit, but expect some added costs. |

| B Lenders | Fast (1–2 weeks) | Higher fees (lender, broker, legal, appraisal) | Good middle ground for bruised credit borrowers. |

| Private Lenders | Fastest (a few days to 1 week) | Highest fees (lender, broker, legal, appraisal, admin) | Best for urgent funding or when banks/B lenders decline. |

🔑 Key Takeaways on Down Payments & Closing Costs

- Down Payments Vary: Banks may allow as little as 5% down with strong credit, while trust companies, B lenders, and private lenders often require 20% or more depending on your credit score and property type.

- Closing Costs Differ: Fees can range from minimal with banks to higher with private lenders, where lender, broker, and administrative charges are more common.

- Speak to a Professional: A mortgage professional can give you a personalized breakdown of both down payment and closing costs, so you know exactly what to expect before moving forward.

FAQs: Bad Credit Mortgages in Ontario & Across Canada

Can I get a mortgage in Ontario with a 550 credit score?

Yes, but not with a bank. With a 550 credit score, you’ll typically need to work with a private lender. Approval will depend more on the equity in the property or the size of your down payment.

What is the minimum credit score for a mortgage in Canada in 2025?

-

Banks generally require 680 or higher.

-

Alternative (B) lenders may consider 500–640.

-

Private lenders may approve with under 500, depending on equity.

Are private mortgages safe?

Yes—when arranged through a licensed mortgage broker, private mortgages are legitimate. They often serve as short-term solutions while you rebuild credit.

Can I switch back to a bank lender later?

Absolutely. Many borrowers start with a B lender or private lender and refinance with a bank once their credit improves. (👉 Related: Mortgage Renewal Options for Homeowners with Bad Credit)

Can I buy a home with bad credit in Canada?

Yes. Many homeowners start with a B lender or a private lender to get into the market. (👉 Related: How Can I Purchase A Home With Bad Credit?)

Final Thoughts: You Still Have Options in 2025

A bad credit mortgage in Canada doesn’t mean the end of your homeownership dreams. Whether you’re refinancing to protect your property or buying your first home, there are real solutions available.

Traditional banks may turn you away if your score falls below 640, but alternative lenders and private lenders often step in with flexible, short-term options designed to help.

With time and consistent payments, you can rebuild your credit and eventually transition back to a traditional lender.

👉 Next step: Speak with a licensed mortgage professional. Call us today at 1-855-242-7732 or apply online—your path to approval starts here.

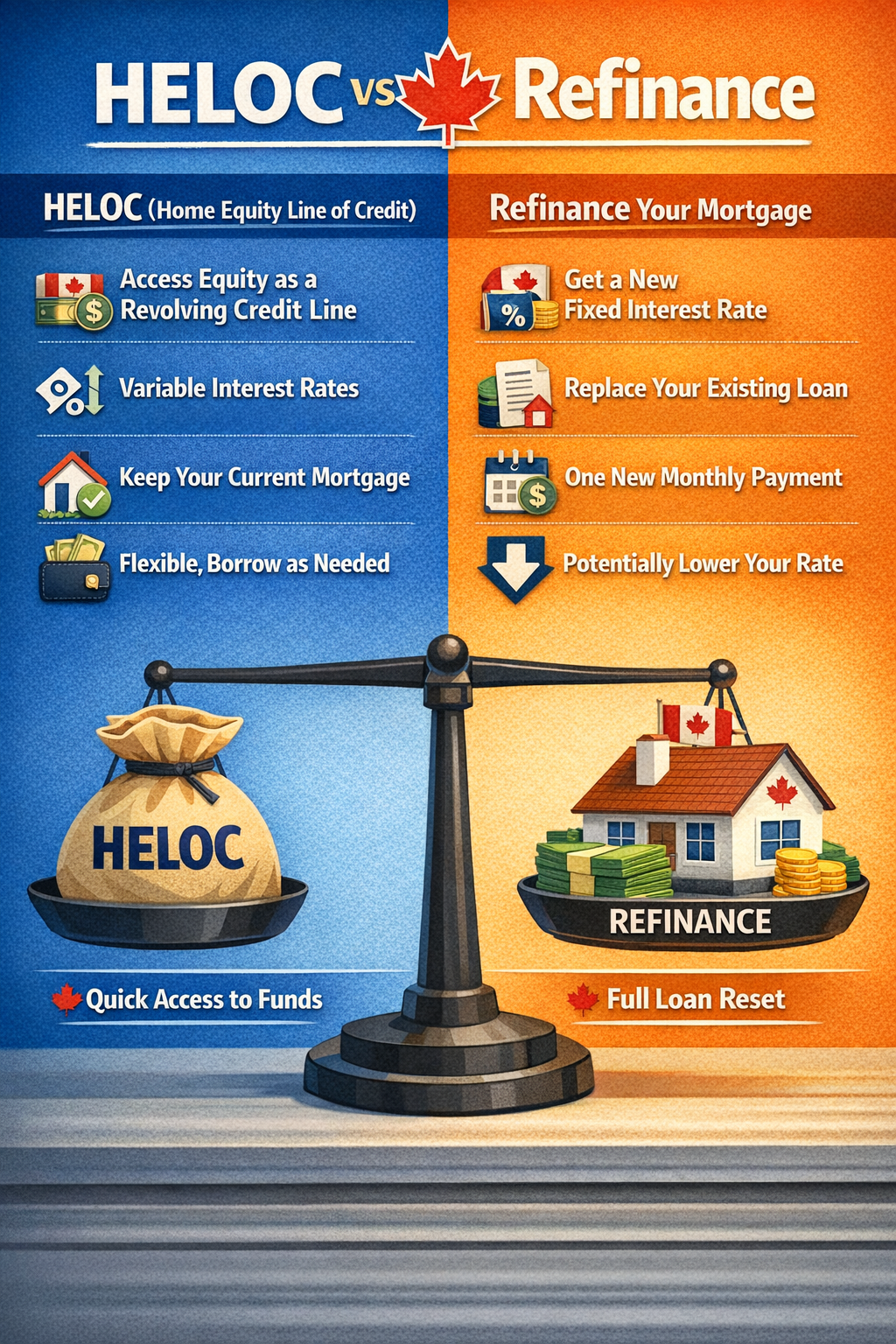

- 7 Smart Truths: HELOC vs Refinance, What’s Cheaper for High-Equity Homeowners? - February 1, 2026

- 9 Powerful Steps to Calculate Your Home Equity Accurately (And Avoid Expensive Surprises) - January 30, 2026

- Property Tax Arrears in Pickering: Risks, Timelines, and Solutions for Homeowners - January 28, 2026