Are you a homeowner in Alberta, juggling multiple high-interest debts like credit cards, personal loans, or tax arrears? You’re not alone. Many homeowners today are facing financial strain due to inflation, rising interest rates, and unexpected expenses. The good news? There are several equity-based solutions available to help resolve financial challenges, including, but not limited to, a second mortgage in Alberta that can consolidate debt, lower monthly payments, and restore financial peace of mind.

In this article, we’ll dive into everything you need to know about second mortgages in Alberta—how they work, who they’re for, and the key differences homeowners must understand to make an informed decision. Even if you’re dealing with bad credit, you’ll learn how home equity can still be used to your advantage.

Table of Contents

ToggleWhy Homeowners in Alberta Turn to a Second Mortgage

High Debt Levels in Alberta

Albertans carry some of the highest consumer debt levels in Canada. According to Equifax, Alberta households consistently rank above the national average for non-mortgage debt. Credit cards, auto loans, and lines of credit can quickly become unmanageable when interest rates spike.

Interest Rates and Inflation Pressure

Rising interest rates have left many homeowners with higher monthly payments and less disposable income. A second mortgage can help by offering lower rates than unsecured debts, giving you room to breathe.

When Banks Say No

Traditional banks often turn away homeowners with bad credit, self-employment (hard to prove), or recent financial issues. That’s where private lenders and alternative lending solutions come in.

What is a Second Mortgage and How Does It Work?

Definition and Structure

A second mortgage, often referred to as a home equity loan, is a loan secured against the equity in your home, on top of your existing first mortgage. It provides a lump-sum amount and typically comes with a fixed term, fixed interest rate, and a structured repayment schedule.

Key Differences from a HELOC or Refinance

- Unlike a HELOC, which is a revolving credit line, a second mortgage provides a lump-sum amount.

- Unlike refinancing, it doesn’t replace your existing mortgage—it simply adds another loan layer.

Common Uses

- Debt consolidation

- Home renovations

- Covering tax and mortgage arrears

- Emergency expenses

How a Second Mortgage in Alberta Helps Consolidate Debts

Example: Rolling Credit Card, Loans, and Tax/Mortgage Arrears Into One

Let’s say you have the following debts:

| Debt Type | Balance | Interest Rate | Monthly Payment |

|---|---|---|---|

| Credit Card #1 | $8,000 | 19.99% | $240 |

| Personal Loan | $12,000 | 14.00% | $350 |

| CRA Tax Arrears | $6,000 | 10.00% + Penalty | $180 |

| Total Before | $26,000 | — | $770 |

| Second Mortgage | $26,000 | 8.99% (*apr 20% estimated) | $410 |

Benefits

- Lower interest rate overall

- Single monthly payment

- Improved cash flow and reduced stress

Key Considerations

- Appraisal fees, lending fees and legal costs may apply

- Choose terms and rates that suit your goals

- Have a clear plan for repayment (exit strategy)

Who Offers Second Mortgages in Alberta?

Institutional Lenders vs. Private Lenders

Institutional lenders (banks, credit unions) are strict about credit, income, and documentation. Private lenders focus more on equity and property condition, making them more suitable for clients with high ratios, reduced income, bad credit and hard-to-prove income.

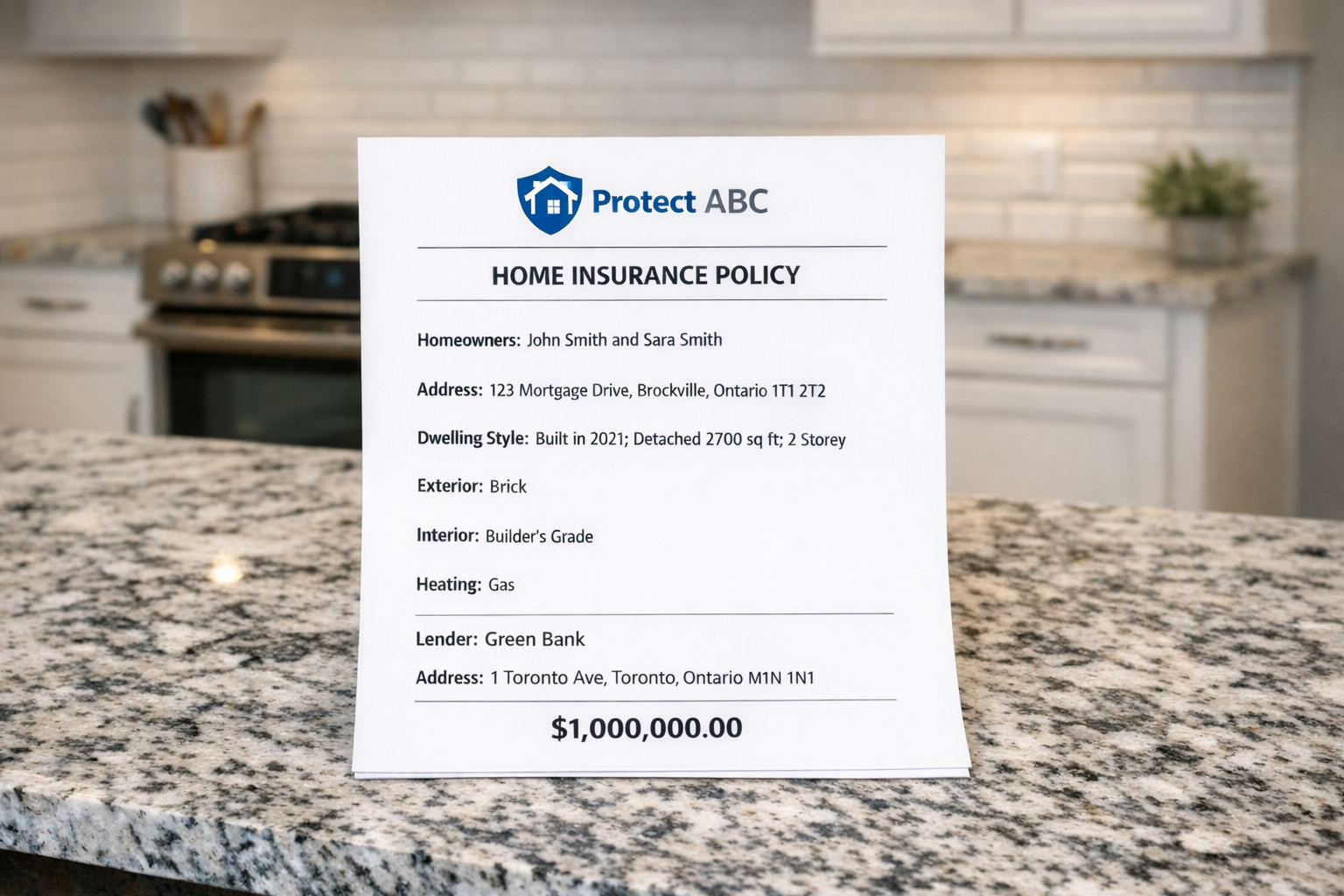

What Institutional Lenders Look For

Institutional lenders typically require a solid credit score (usually 680+), full income verification (including tax returns and employment letters), low debt-to-income ratios, and consistent payment history. As with all lenders, they will request a detailed appraisal and proof of property insurance. While institutional lenders generally offer lower interest rates and longer terms, qualifying can be challenging, especially for borrowers with financial hardships or non-traditional income sources.

It’s always ideal to work with institutional lenders when possible, as they offer stability and lower costs. However, for many homeowners in Alberta facing credit issues, cash flow problems, or urgency, this route isn’t always realistic.

Why Private Lenders Are More Flexible

Private lenders assess risk differently than traditional banks, focusing more on the equity in your home than your credit score or income history. If you have at least 20% equity, there’s a strong chance you can qualify, even with bruised credit or limited income documentation. This makes them a valuable option for homeowners who don’t meet strict bank criteria, and in many cases, your personal story and circumstances can make a meaningful difference in the approval process.

Loan-to-Value (LTV) and Equity Requirements

Most lenders will go up to 80% LTV provided the home is within their lending area and meets the condition requirements.

For example:

- Home value: $500,000

- Existing mortgage: $350,000

- Max 2nd mortgage: $50,000 (to keep LTV at 80%)

How to Qualify for a Second Mortgage in Alberta

Equity is King

You generally need 20% or more equity in your home. The more equity, the better your options.

Credit Score: Not a Dealbreaker

A low credit score doesn’t automatically disqualify you. Private lenders often approve second mortgages for clients with bad credit.

Income and Property Location

Income may help improve your rate, but it isn’t always required. Properties in urban or suburban Alberta tend to qualify more easily due to market stability.

Case Study Example: Consolidating Debts with a Second Mortgage

Angela, a homeowner in Calgary, had a credit score of 570 and was behind on property taxes. With $100,000 in home equity, she secured a second mortgage in Alberta for $40,000.

The funds helped her pay off:

- $20,000 in credit card debt

- $10,000 in tax arrears

- $10,000 in renovation expenses

Her monthly payments dropped by $500, and her credit score began to recover.

Common Myths About Getting a Second Mortgage in Alberta

“I Need Perfect Credit”

False. Many borrowers qualify with poor or fair credit scores (bad credit).

“Second Mortgages Are Too Expensive”

While rates may be higher than traditional mortgages, they’re often lower than credit cards or payday loans.

“Only Banks Can Offer Mortgages”

Alternative ‘B’ lenders and private mortgage lenders in Alberta can offer faster approvals and more flexible terms.

Steps to Apply for a Second Mortgage in Alberta

- Assess Your Home’s Equity (speak to a professional or use an equity calculator)

- Gather Financial Documents (e.g., ID, mortgage statement, property tax bill)

- Speak to a Mortgage Professional who can assist with your Alberta mortgage request

- Compare Lenders and Offers (private vs. institutional)

- Apply and Get Funded (usually within 5–10 business days)

- Use Funds to Consolidate Debts and Improve Cash Flow

Key Takeaways for Homeowners

- A second mortgage in Alberta is ideal for debt consolidation, even with bad credit

- Private lenders provide flexible approvals based on home equity

- You can reduce your monthly debt payments significantly

✅ FAQ

Q: Can I get a second mortgage in Alberta if I have bad credit?

A: Yes. Many alternative mortgage lenders in Alberta prioritize your home equity over your credit score. As long as you have at least 20% equity, you may qualify, even with poor or bruised credit.

Q: What is the interest rate on a second mortgage in Alberta?

A: Rates vary depending on your lender type, credit profile, and loan-to-value (LTV). Institutional lenders may offer lower rates but stricter requirements. Private lenders offer flexibility, with rates typically starting at 7%–13%.

Q: How much can I borrow with a second mortgage?

A: Most lenders in Alberta allow up to 80% of your home’s appraised value, including your existing mortgage. The actual amount depends on your equity and property condition.

Q: Are second mortgage funds restricted in how I use them?

A: No. You can use second mortgage funds for debt consolidation, tax/mortgage arrears, home repairs, business funding, or emergencies. It is important to work with a mortgage professional to ensure you have a solid repayment strategy.

Q: How long does it take to get a second mortgage in Alberta?

A: With private lenders, approvals can happen within 24–48 hours, and funding within 5–10 business days, depending on appraisal and legal processing.

Final Thoughts: Why a Second Mortgage in Alberta Could Be the Right Move

Don’t let high-interest debts, bad credit and financial stress control your future. A second mortgage in Alberta gives you access to your home equity to solve urgent problems—fast. Whether you’re behind on payments or simply trying to improve cash flow, now is the time to explore your options.

Speak with a mortgage professional to share your story—how you got to where you are and where you want to go. Understanding your full financial picture helps uncover short-term solutions and long-term strategies using your home equity. It’s the first step toward building a clear, sustainable path forward.

Help? Second Mortgage in Alberta

- Can a Mortgage Company Evict You in Ontario? (2026 Power of Sale Guide) - February 23, 2026

- Crucial Ways to Survive the Redemption Period During Foreclosure: A Guide - February 21, 2026

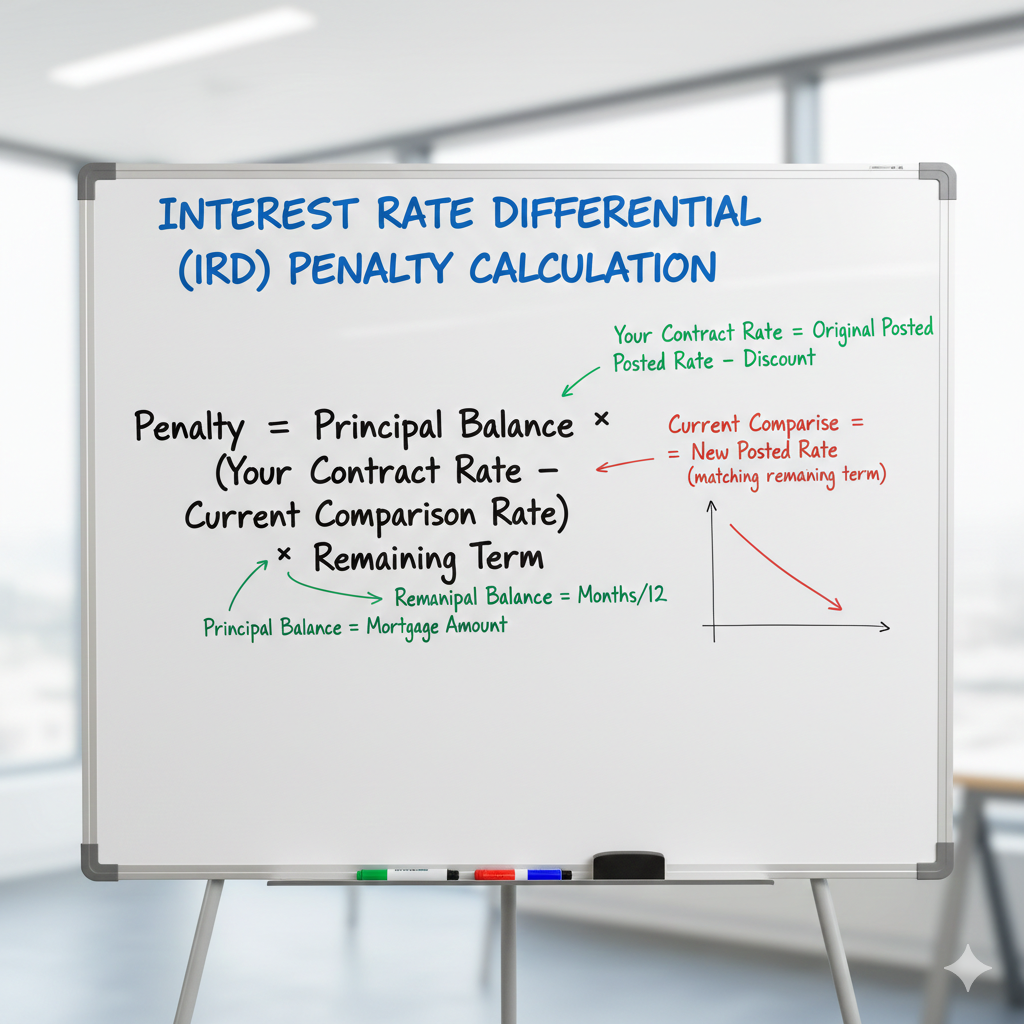

- Painful Realities of the Interest Rate Differential Penalty You Must Know - February 15, 2026